Shocking truth! Why loan apps in Nigeria keeps rejecting your loan requests?

Applying for short term loan from licensed loan apps like Kwikpay Credit (Trafalgar) is easy but approval of such loans will depend on being able to meet the simple requirements and conditions of the requested loan.

Despite the simplicity of Kwikpay Credit loan app and being one of the best loan apps in Nigeria, some of the loan applications are still declined and rejected. Identifying the major reasons for the loan rejection may be difficult for most applicants.

Here are some of the key reasons for the rejection. We realise that such rejection can be disappointing especially when the loan request is needed in an emergency, hence this write-up to understand the process and how to move forward.

- You didn’t meet the basic requirements

Every lender sets its own requirements, but most look for a few basic criteria, such as,

minimum age requirement (typically 18), valid bank account, mobile number and BVN. It is important that you check the basic requirements and ensure you can meet them, before applying.

2.Your application was missing information

A lender might automatically reject your application if it’s missing key information or documents. Make sure to read over your application before you submit it, as well as upload any supporting documentation that the lender requires. You might also call Kwikpay Credit or any of the registered loan mobile app (digital lenders approved and registered by Federal Government of Nigeria FCCPC) directly to double check that it received everything it needed to process your application.

- Your Credit Reports from Credit reference Agencies licensed by CBN

Your credit report from the Licensed Credit registry acts as one of the key areas for lenders when making their final decision. The report shows your personal information, including your name, your current and previous addresses, employers, etc. It will also include data regarding your credit history, for example, late payments, credit accounts, and recent loan inquiries, as well as other general information that a lender will find useful.

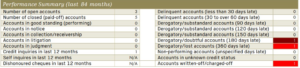

Example of Report from CBN licensed Credit Reference Agencies

- Your income was insufficient or unstable

Along with looking at your current and previous credit history from the registered credit reference agencies in Nigeria, lenders and loan apps like Kwikpay Credit also examine your income to determine whether you’ll be able to pay back your loan. Essentially, they want to make sure you can afford your monthly payments and won’t default on the money you owe. We usually request for your 3months bank income statements. If we decide that your income is insufficient for the amount you want to borrow or based on other loan obligations or if it your income appears unstable from month to month — the lender may reduce the loan approved for you or might reject your application outright.

For example, if you try to take out a personal loan from Kwikpay loan app or online of N100,000, knowing that you don’t earn enough salary or income to afford the monthly loan repayment. Since you’re requesting an unrealistic amount, we or other lenders will most certainly deny you

5.You’ve Applied Too Many Times

Despite being far from the truth, many people believe that applying to multiple lenders and creating a number of applications will increase their chances of being accepted. However, this can be extremely harmful to both you and your finances, since it could reduce your chances of acceptance. Whenever you submit a new application, the lender will conduct a credit check on your finances. The credit reference check will show how many loan apps or companies you have applied to within a short time, and if it is shown that you applied to many loan companies within same period, your chances of getting the loan approved might reduce.

As a result, before applying for a loan, you should familiarise yourself with how lenders operate and the risks involved.

For more information about our loan app or applying online for a loan in Lagos or any state in Nigeria, do not hesitate to use or contact Kwikpay Credit, www.kwikpaycredit.com

Kwikpay Credit is the trading style of Trafalgar Associates Limited, a licensed and registered digital lender with Federal Government of Nigeria’s FCCPC, and a member of Money Lenders Association.

Recent Comments